When Is Form 1096 Due For 2024

When Is Form 1096 Due For 2024. The filing due date for other 1099 forms is february 28, 2024, if filed by paper, and march 31, 2024, if filed electronically. When is the last day to file taxes in 2024?

If you are required to file these information returns and fail to file or fail to furnish forms by the due date, then you may be subject to the following irs penalties:. With this program, eligible taxpayers can prepare and file their federal tax returns using.

Fourth Quarter Estimated Payments Due For The Tax Year 2023:

Subject to erisa and the internal revenue code.

Small Business Resource Center Small Business Tax Prep.

Having said that, the recipient copy deadline for most 1099 forms is january 31, 2024.

If Your Business Paid Independent Contractors Or Freelancers In 2023, You Must File Irs Form.

Images References :

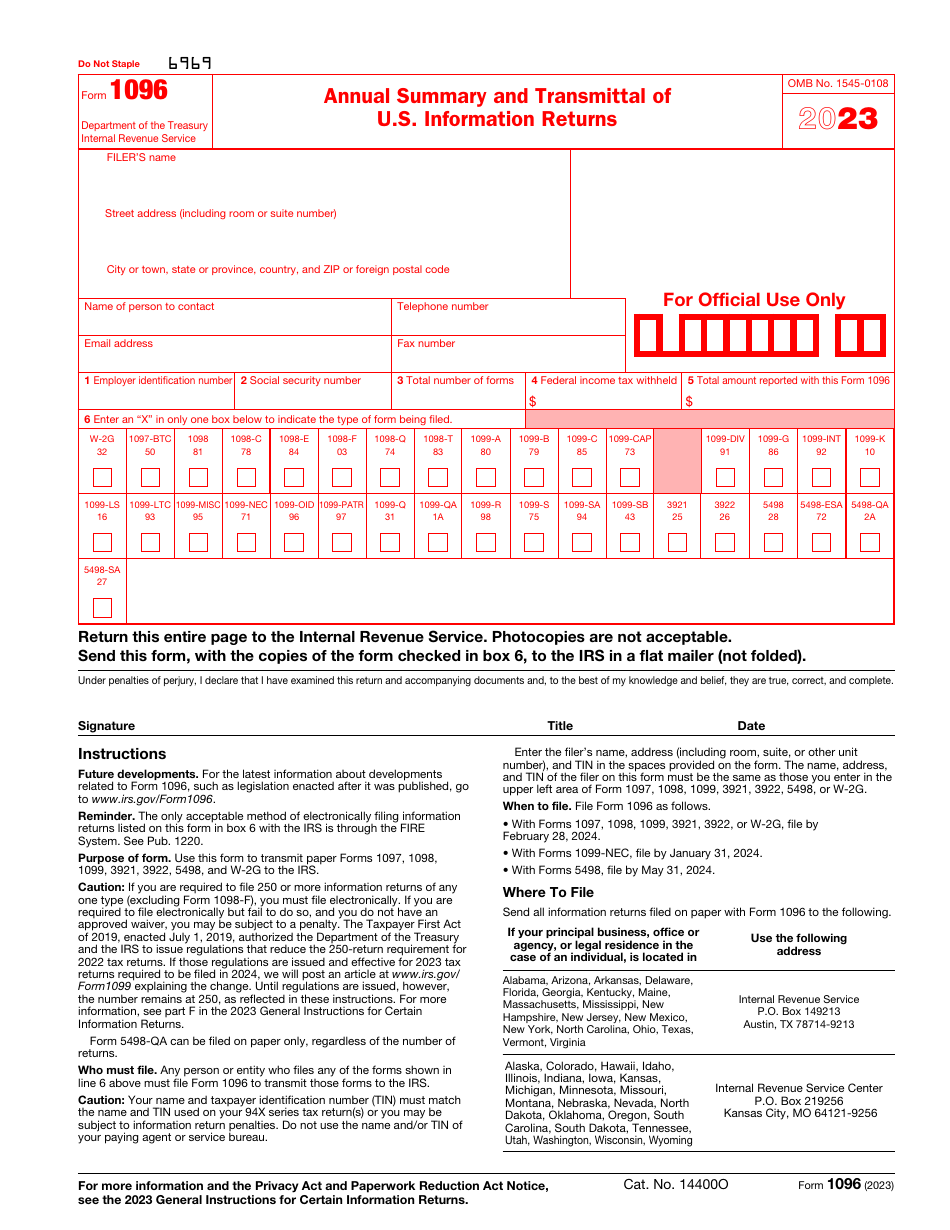

Source: remote.com

Source: remote.com

What is a 1096 Form? A Guide for US Employers Remote, However, there are some exceptions to this deadline: 22, 2024 — irs free file is now available for the 2024 filing season.

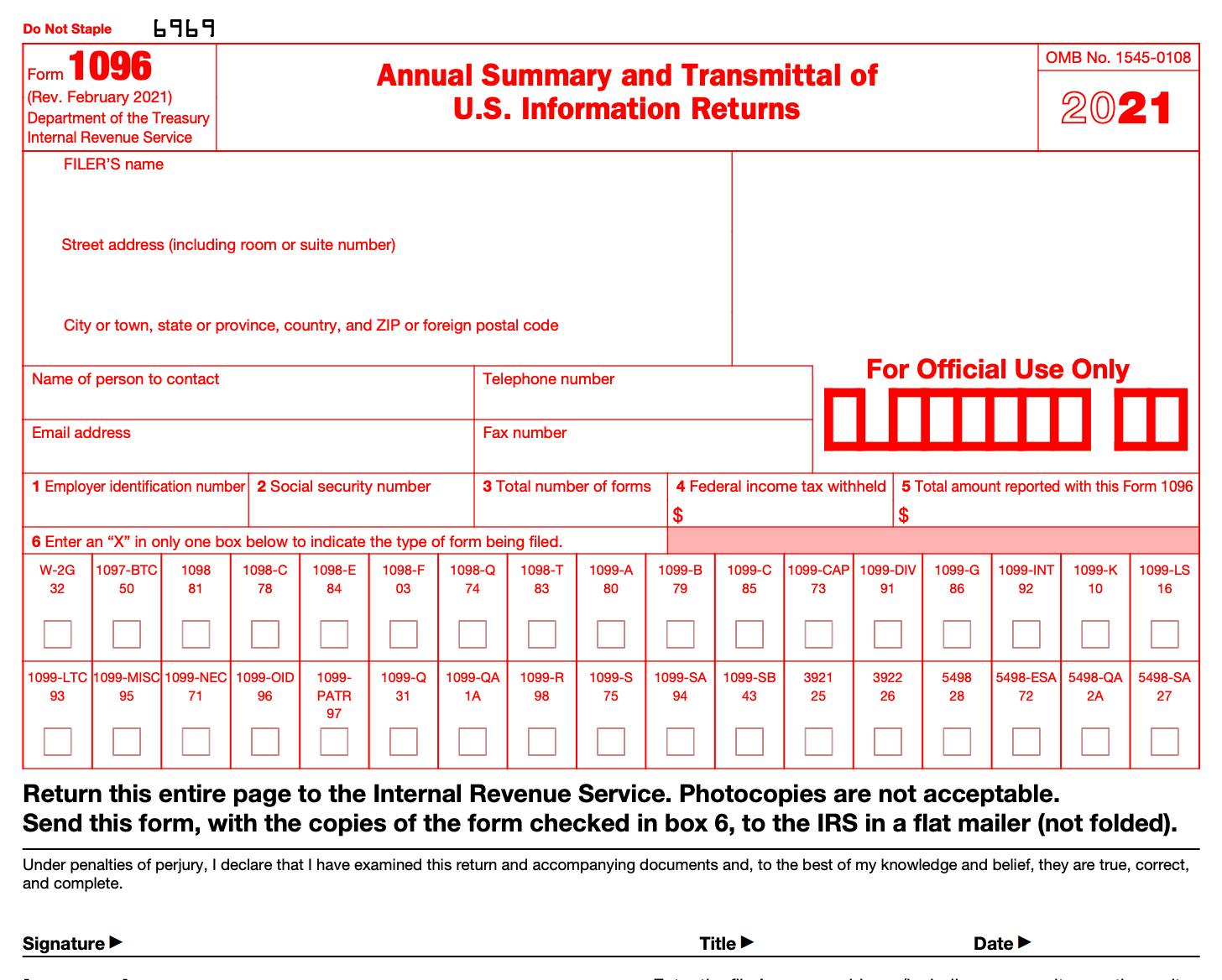

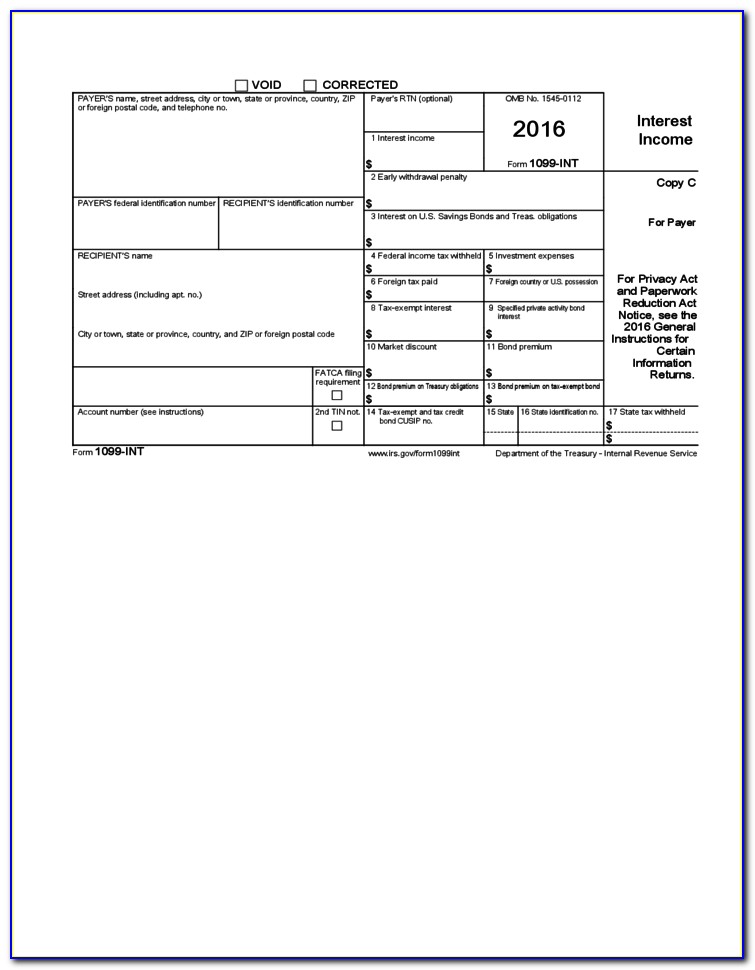

Source: www.pdfquick.com

Source: www.pdfquick.com

1096 IRS Fill, Save, Print & Share Forms Online ID 404 PDFQuick, If you are required to file these information returns and fail to file or fail to furnish forms by the due date, then you may be subject to the following irs penalties:. The standard penalty is 5% of any tax due for every month the return is late, up to 25% of the unpaid balance.

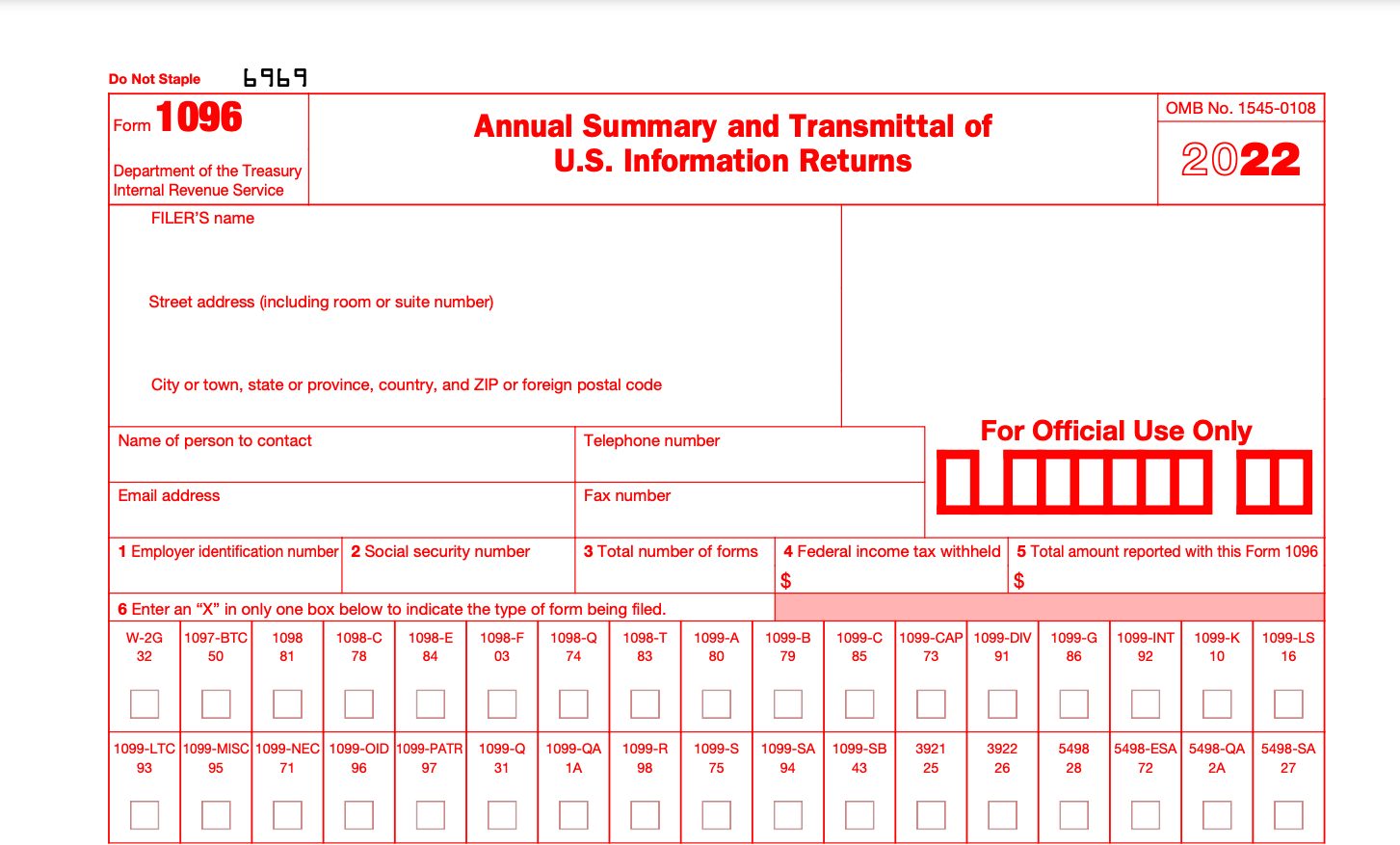

Source: www.templateroller.com

Source: www.templateroller.com

IRS Form 1096 Download Fillable PDF or Fill Online Annual Summary and, Keep your federal tax planning strategy on track with key irs filing dates. With this program, eligible taxpayers can prepare and file their federal tax returns using.

Source: www.bench.co

Source: www.bench.co

Form 1096 A Simple Guide Bench Accounting, However, there are some exceptions to this deadline: Our 2024 tax calendar gives you a quick.

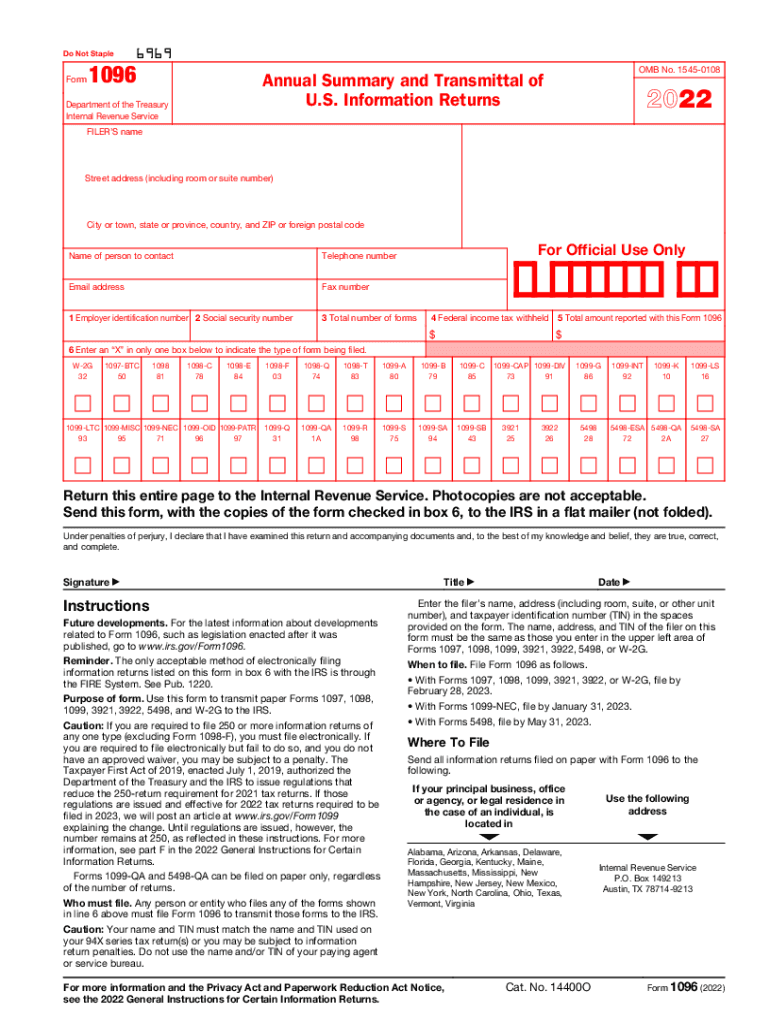

Source: www.signnow.com

Source: www.signnow.com

1096 20222024 Form Fill Out and Sign Printable PDF Template, However, all sums deducted by an office of the. (the irs also receives a copy.) your job is then to review the.

Source: admin.cashier.mijndomein.nl

Source: admin.cashier.mijndomein.nl

Printable Form 1096, Having said that, the recipient copy deadline for most 1099 forms is january 31, 2024. The irs typically requires form 1096 to be filed by january 31st following the end of the tax year.

Source: stephanawelset.pages.dev

Source: stephanawelset.pages.dev

1096 Due Date 2024 Due Dates Vina Aloisia, Filing form 1096 is mandatory when a business has paid $600 or more to a freelancer or independent contractor during the calendar year. However, all sums deducted by an office of the.

Source: www.taxbandits.com

Source: www.taxbandits.com

IRS Form 1096 Transmittal of 1099 Form Generate 1096 Form Online, The penalties for missing these deadlines can vary depending on the timing of the filing—and how late it is. Keep your federal tax planning strategy on track with key irs filing dates.

Source: www.denizen.io

Source: www.denizen.io

Printable 1096 Form 2021 Customize and Print, Subject to erisa and the internal revenue code. The filing due date for other 1099 forms is february 28, 2024, if filed by paper, and march 31, 2024, if filed electronically.

Source: pohguide.weebly.com

Source: pohguide.weebly.com

Free irs form 1096 template pohguide, 22, 2024 — irs free file is now available for the 2024 filing season. With this program, eligible taxpayers can prepare and file their federal tax returns using.

Having Said That, The Recipient Copy Deadline For Most 1099 Forms Is January 31, 2024.

With this program, eligible taxpayers can prepare and file their federal tax returns using.

Form 1096, Annual Summary And Transmittal Of U.s.

Subject to erisa and the internal revenue code.